Mastering Your Finances: A Guide to Effective Bill Management with a Printable Calendar for 2026

Related Articles: Mastering Your Finances: A Guide to Effective Bill Management with a Printable Calendar for 2026

Introduction

With great pleasure, we will explore the intriguing topic related to Mastering Your Finances: A Guide to Effective Bill Management with a Printable Calendar for 2026. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Mastering Your Finances: A Guide to Effective Bill Management with a Printable Calendar for 2026

In the contemporary world, where financial obligations are ever-present, effective bill management is paramount for maintaining financial stability and achieving personal financial goals. A well-structured system for tracking and paying bills on time is essential for avoiding late fees, maintaining a positive credit score, and ultimately, achieving financial peace of mind. A printable bill calendar for 2026 emerges as a powerful tool for simplifying this process, offering a comprehensive and customizable solution for managing financial responsibilities.

The Power of a Printable Bill Calendar:

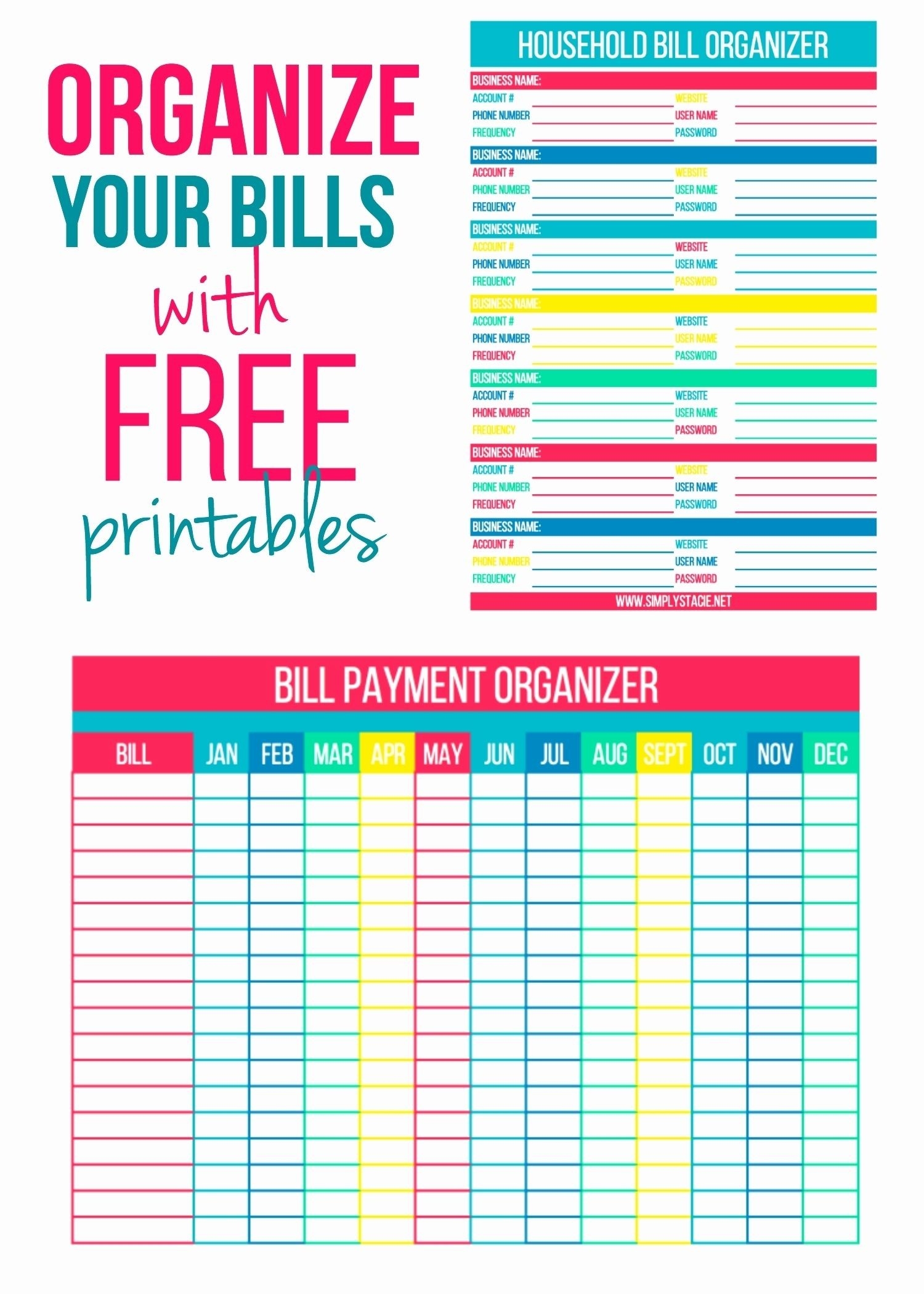

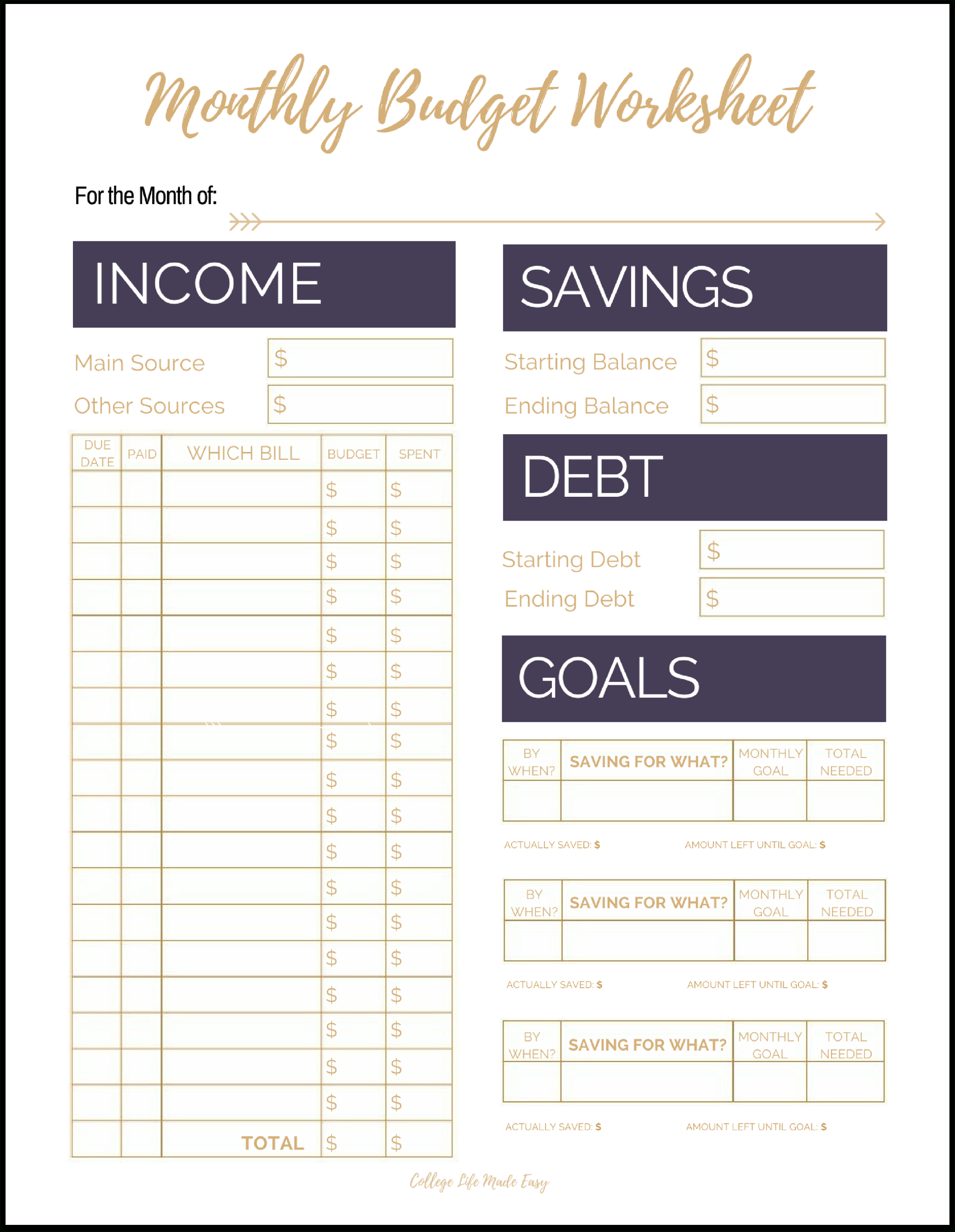

A printable bill calendar serves as a central hub for organizing and tracking all financial obligations. Its design, typically featuring a monthly or weekly layout, provides dedicated spaces for recording due dates, amounts, and any relevant notes. This visual representation of financial commitments allows individuals to:

- Gain a comprehensive overview of upcoming bills: The calendar provides a clear and concise snapshot of all due dates, enabling individuals to anticipate upcoming financial obligations and plan accordingly.

- Avoid late fees and penalties: By visually highlighting upcoming due dates, the calendar serves as a constant reminder, minimizing the risk of missed payments and associated penalties.

- Optimize cash flow management: The calendar facilitates proactive budgeting by enabling individuals to anticipate large expenses and adjust spending patterns accordingly.

- Promote financial discipline: The act of actively recording and tracking bills encourages a sense of responsibility and accountability, fostering financial discipline and promoting healthy spending habits.

Key Features of a Printable Bill Calendar for 2026:

A well-designed printable bill calendar for 2026 incorporates key features that enhance its usability and effectiveness:

- Clear and concise layout: The calendar should adopt a simple and intuitive design, with ample space for recording essential information such as bill names, due dates, amounts, and payment methods.

- Customizable options: The calendar should allow for personalization, enabling users to tailor it to their specific needs. This could include adding additional columns for notes, payment confirmations, or reminders.

- Flexibility in format: The calendar should be available in both monthly and weekly formats, providing users with the option to choose the layout that best suits their organizational preferences.

- Digital and printable options: Offering both digital and printable versions ensures accessibility and convenience, allowing users to access and manage their bills on their preferred devices.

Beyond Basic Functionality: Embracing Advanced Features:

While basic bill tracking is essential, a comprehensive printable calendar for 2026 can incorporate advanced features to enhance its functionality:

- Recurring bill reminders: The calendar can be designed to automatically generate reminders for recurring bills, such as monthly utility payments or subscriptions, eliminating the need for manual input.

- Integration with budgeting tools: The calendar can be linked to budgeting apps or spreadsheets, allowing for seamless synchronization of financial data and facilitating informed financial decision-making.

- Payment tracking: The calendar can include a section for recording payment confirmations, providing a complete record of all financial transactions.

- Debt management tools: The calendar can incorporate features for tracking debt balances, interest rates, and repayment plans, aiding in debt reduction strategies.

Benefits of Utilizing a Printable Bill Calendar for 2026:

The benefits of employing a printable bill calendar extend beyond simple bill organization. By embracing this tool, individuals can:

- Reduce financial stress: Knowing that bills are being tracked and paid on time significantly reduces anxiety and stress related to financial obligations.

- Improve credit score: Consistent bill payments contribute to a positive credit history, leading to improved credit scores and access to better financial products.

- Boost financial literacy: The act of actively managing bills fosters a deeper understanding of personal finances and promotes financial literacy.

- Achieve financial goals: With a clear understanding of spending patterns and upcoming obligations, individuals can effectively allocate resources towards achieving their financial goals, whether it be saving for a down payment on a home or investing for retirement.

FAQs Regarding Printable Bill Calendars:

Q: What is the best way to choose a printable bill calendar?

A: The ideal calendar will depend on individual needs and preferences. Consider factors such as:

- Layout: Monthly or weekly format?

- Customization options: Ability to add notes, reminders, or payment confirmation sections?

- Digital or printable: Which format is most convenient?

- Integration capabilities: Compatibility with budgeting apps or spreadsheets?

Q: How can I ensure I use the bill calendar effectively?

A: To maximize the benefits of a printable bill calendar, consider:

- Consistency: Make it a habit to record all bills and their due dates promptly.

- Accessibility: Keep the calendar in a visible location where it can be easily accessed.

- Regular review: Review the calendar regularly to stay on top of upcoming payments.

Q: Can I use a printable bill calendar for multiple people?

A: While a single calendar can be used for multiple individuals, it is advisable to create separate calendars for each person to maintain clarity and avoid confusion.

Tips for Optimizing Bill Management with a Printable Calendar:

- Categorize bills: Group bills by type (e.g., utilities, subscriptions, credit cards) for easier management.

- Set reminders: Use the calendar to set reminders for upcoming due dates, especially for bills with irregular payment cycles.

- Track payment confirmations: Record payment confirmations in the calendar to ensure all bills have been paid.

- Review and adjust: Regularly review the calendar and adjust spending habits based on financial goals and priorities.

Conclusion:

A printable bill calendar for 2026 is an invaluable tool for individuals seeking to streamline their financial management and achieve financial peace of mind. By providing a centralized platform for tracking bills, managing cash flow, and fostering financial discipline, the calendar empowers individuals to take control of their finances and work towards their financial goals. By embracing this simple yet effective strategy, individuals can navigate the complexities of modern finances with confidence and achieve financial stability.

Closure

Thus, we hope this article has provided valuable insights into Mastering Your Finances: A Guide to Effective Bill Management with a Printable Calendar for 2026. We appreciate your attention to our article. See you in our next article!