Navigating the 2026 Colombian Income Tax Calendar for Individuals: A Comprehensive Guide

Related Articles: Navigating the 2026 Colombian Income Tax Calendar for Individuals: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2026 Colombian Income Tax Calendar for Individuals: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2026 Colombian Income Tax Calendar for Individuals: A Comprehensive Guide

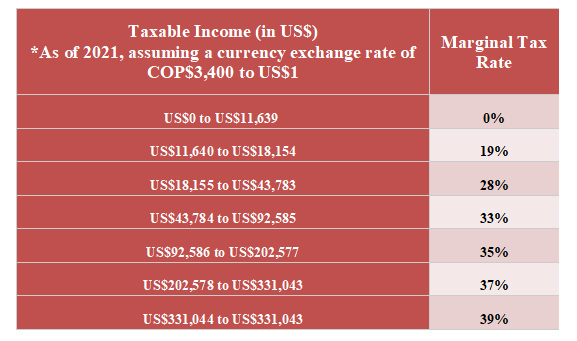

The Colombian tax system, like many others, operates on a calendar-based schedule. Understanding this schedule is crucial for individuals, as it dictates when income tax payments are due and provides a framework for efficient financial planning. This article aims to provide a comprehensive overview of the 2026 Colombian income tax calendar for individuals (known as "renta persona natural"), highlighting key deadlines and providing insights into the tax obligations for individuals in Colombia.

Understanding the Colombian Income Tax Calendar for Individuals

The 2026 Colombian income tax calendar for individuals is designed to facilitate the timely and accurate filing of income tax returns. It outlines specific deadlines for various tax-related activities, including:

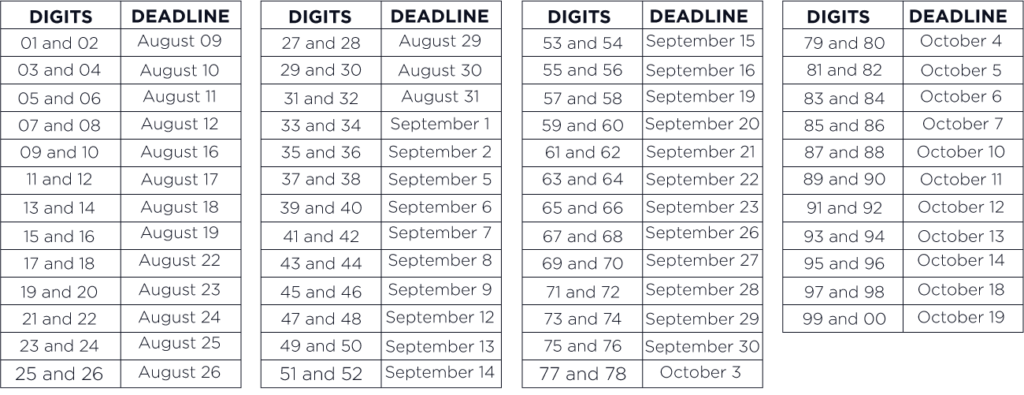

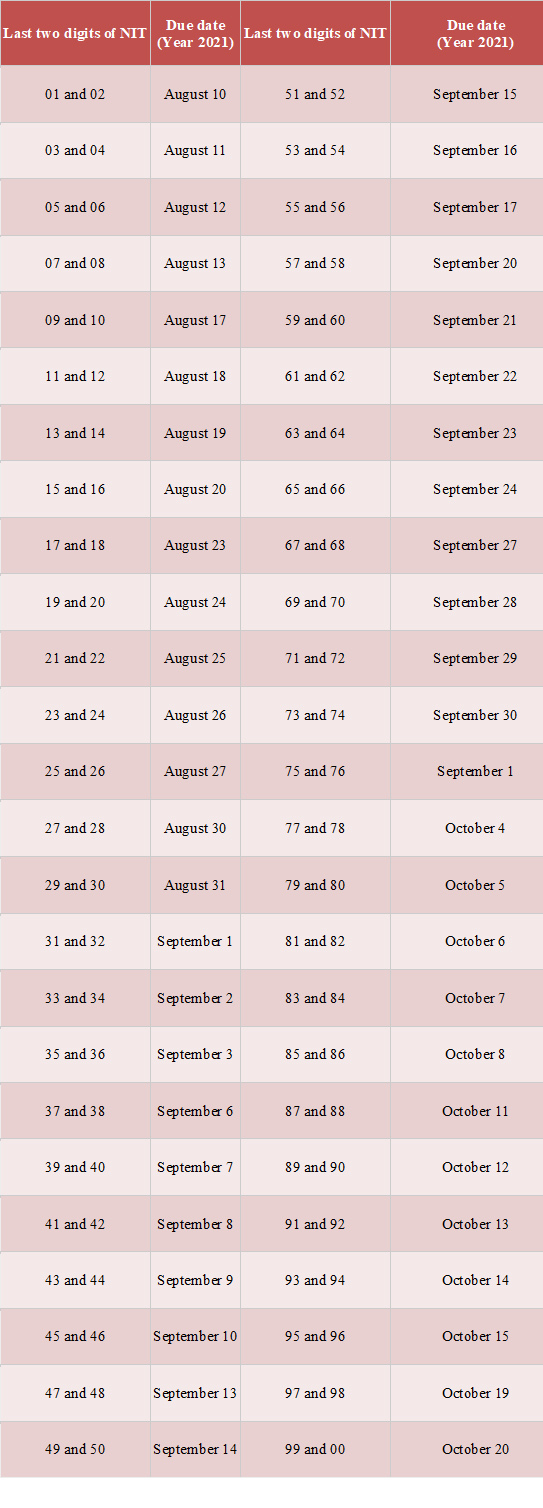

- Declaration Filing: Individuals are required to file their income tax returns within a specific timeframe. The exact deadline depends on various factors, such as income level, employment status, and the type of income earned.

- Tax Payment: After filing the income tax return, individuals may be required to make tax payments based on their calculated tax liability. The calendar outlines the due dates for these payments.

- Information Reporting: Individuals are required to report certain information to the tax authorities, such as income from specific sources, deductions claimed, and other relevant data. The calendar specifies the deadlines for these reporting obligations.

Key Deadlines in the 2026 Calendar

The following are some of the key deadlines that individuals should be aware of in the 2026 Colombian income tax calendar:

- Declaration Filing Deadline: The deadline for filing income tax returns for the 2025 tax year will likely be in the first few months of 2026. This deadline may vary depending on the individual’s income level and other factors.

- Tax Payment Deadlines: Tax payments are typically due within a specified period after the declaration filing deadline. The exact payment dates will be outlined in the official calendar.

- Information Reporting Deadlines: Various deadlines exist for reporting specific information, such as income from rental properties or investments. These deadlines are generally set within a specific timeframe after the income-generating activity.

Importance of Adhering to the Calendar

Adhering to the 2026 Colombian income tax calendar is crucial for individuals for several reasons:

- Avoiding Penalties: Failing to meet deadlines can result in penalties, including fines and interest charges.

- Maintaining Compliance: Staying compliant with tax laws ensures individuals are fulfilling their legal obligations as citizens.

- Ensuring Accurate Tax Liability: Following the calendar helps ensure accurate calculation of tax liability, preventing potential overpayment or underpayment.

Navigating the Calendar: Resources and Tools

The Colombian tax authorities, DIAN (Dirección de Impuestos y Aduanas Nacionales), provide various resources to help individuals navigate the income tax calendar:

- Official Website: DIAN’s website offers comprehensive information on tax laws, regulations, and deadlines.

- Tax Information Guides: DIAN publishes detailed guides and manuals explaining various aspects of the tax system, including income tax obligations.

- Online Filing Platform: The DIAN website provides a secure online platform for filing income tax returns and making tax payments.

Frequently Asked Questions (FAQs)

Q: Who is required to file an income tax return in Colombia?

A: Individuals residing in Colombia and earning income above a certain threshold are generally required to file an income tax return. The specific income threshold varies depending on factors like age and employment status.

Q: What documents are needed to file an income tax return?

A: Required documents typically include identification documents, income statements, receipts for deductions, and other relevant financial information.

Q: What are the common deductions available for individuals?

A: Common deductions include expenses for health, education, housing, and other eligible items.

Q: What happens if I miss the deadline to file my income tax return?

A: Missing the deadline can result in penalties, including fines and interest charges. It’s crucial to contact DIAN immediately if you anticipate missing a deadline.

Tips for Effective Tax Planning

- Maintain Accurate Records: Keep detailed records of all income and expenses for tax purposes.

- Seek Professional Advice: Consult with a tax advisor or accountant for personalized guidance on your specific tax situation.

- Plan for Tax Payments: Budget for tax payments throughout the year to avoid financial strain during the filing season.

- Stay Updated on Changes: Tax laws and regulations can change, so it’s essential to stay informed about any updates or modifications.

Conclusion

The 2026 Colombian income tax calendar for individuals provides a roadmap for navigating tax obligations efficiently. By understanding the key deadlines and utilizing available resources, individuals can ensure compliance with tax laws, avoid penalties, and manage their financial obligations effectively. Proactive planning and adherence to the calendar are crucial for minimizing tax-related stress and maximizing financial well-being.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2026 Colombian Income Tax Calendar for Individuals: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!