The 5-4-4 Accounting Calendar: Navigating Financial Year-End in 2026

Related Articles: The 5-4-4 Accounting Calendar: Navigating Financial Year-End in 2026

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The 5-4-4 Accounting Calendar: Navigating Financial Year-End in 2026. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The 5-4-4 Accounting Calendar: Navigating Financial Year-End in 2026

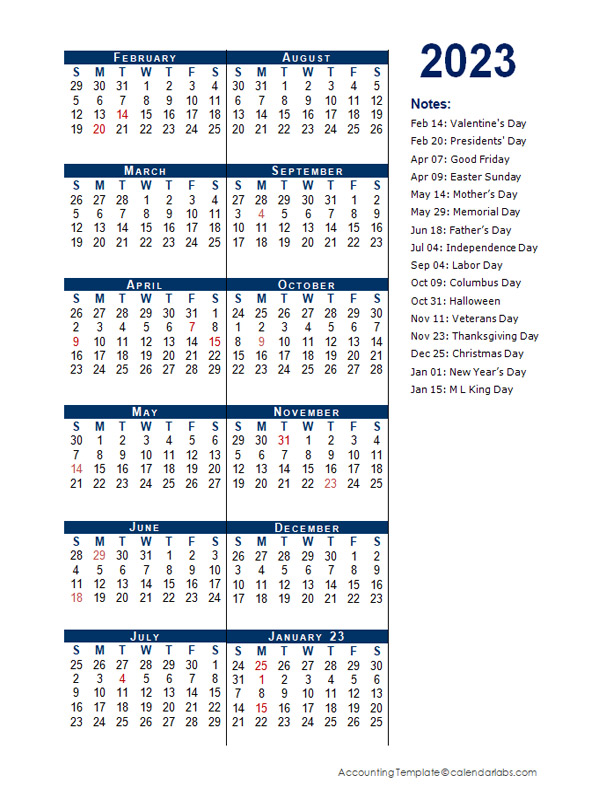

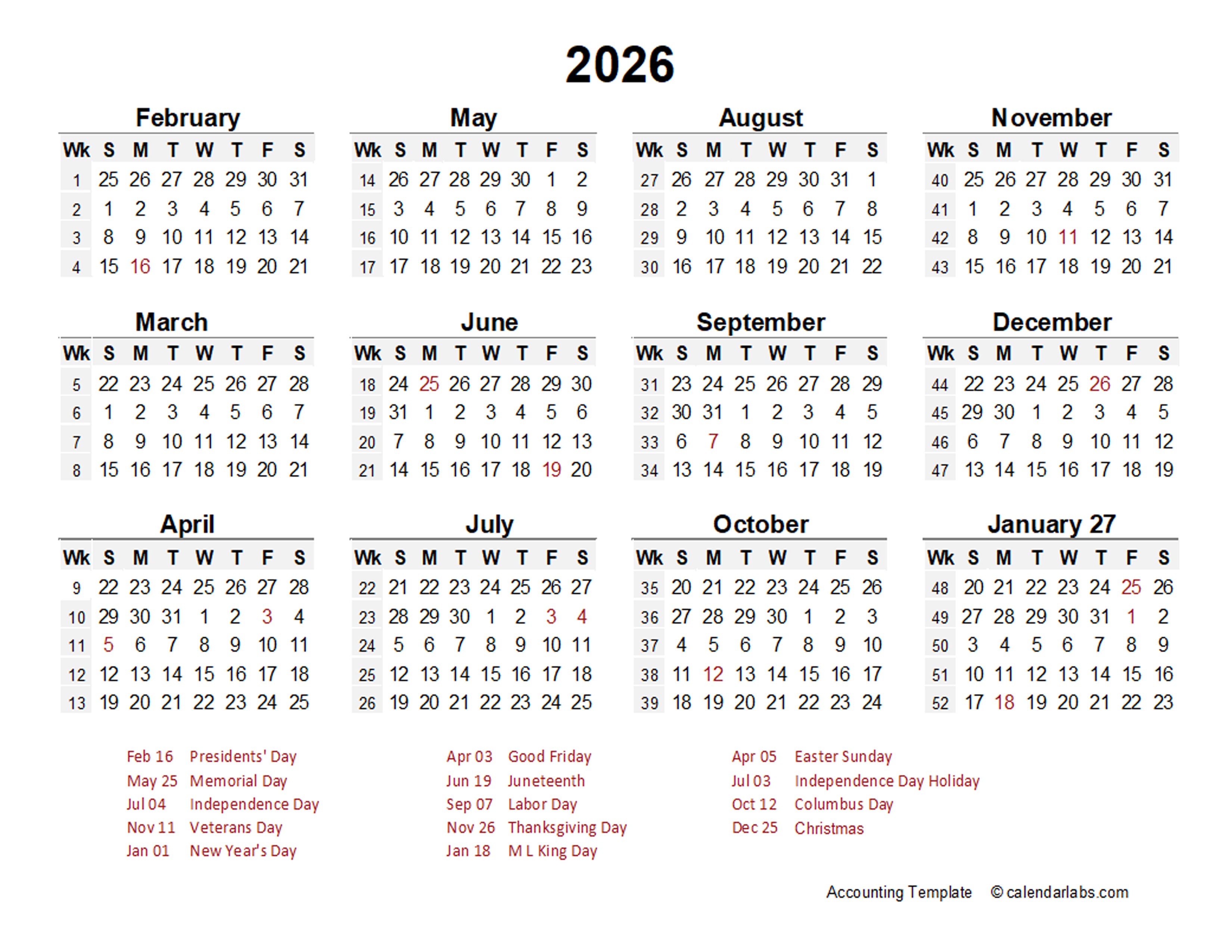

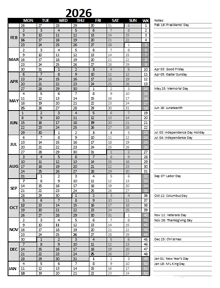

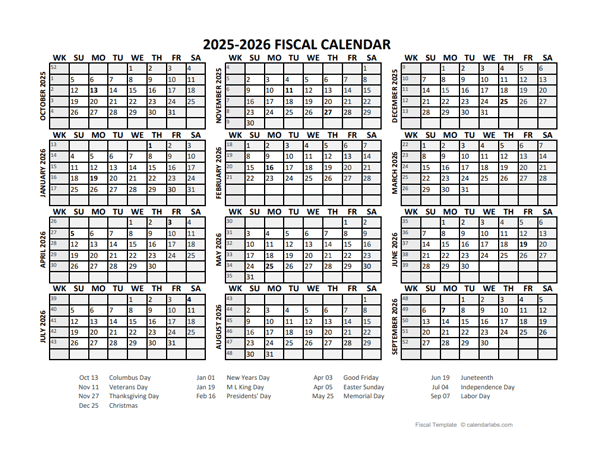

The accounting calendar plays a crucial role in the smooth operation of any business. It provides a framework for financial reporting, tax compliance, and overall financial management. While traditional calendars often follow a standard 12-month structure, the 5-4-4 accounting calendar presents an alternative approach that can offer significant benefits for businesses seeking to optimize their financial cycles.

Understanding the 5-4-4 Accounting Calendar

The 5-4-4 accounting calendar, as the name suggests, divides the year into three distinct periods:

- Five-month periods: These periods typically run from January to May and September to January.

- Four-month periods: These periods typically run from June to September.

This structure allows for a more flexible approach to financial reporting and tax compliance, particularly for businesses with seasonal fluctuations in revenue or activity.

Advantages of the 5-4-4 Accounting Calendar

The 5-4-4 accounting calendar offers several advantages over the traditional 12-month calendar, including:

1. Improved Financial Planning and Control:

The 5-4-4 calendar provides a more granular view of financial performance, allowing businesses to track revenue and expenses more closely. This detailed analysis can lead to better budgeting, forecasting, and overall financial control.

2. Enhanced Cash Flow Management:

By aligning the accounting year with seasonal peaks and troughs, businesses can better manage their cash flow. This can be particularly beneficial for industries with cyclical revenue patterns.

3. Optimized Tax Compliance:

The 5-4-4 calendar allows for a more strategic approach to tax planning. By aligning tax deadlines with periods of lower revenue, businesses can potentially minimize their tax liabilities.

4. Increased Operational Efficiency:

The 5-4-4 calendar can streamline accounting processes by simplifying financial reporting and tax compliance requirements. This can free up valuable time and resources for other business activities.

5. Improved Stakeholder Communication:

The 5-4-4 calendar can improve communication with stakeholders, including investors, creditors, and regulators. By providing more frequent financial updates, businesses can enhance transparency and build trust.

Implementing the 5-4-4 Accounting Calendar

Implementing the 5-4-4 accounting calendar requires careful planning and coordination. Businesses need to consider the following factors:

- Industry-specific regulations: Certain industries may have specific regulations regarding accounting calendars.

- Internal processes: Businesses need to assess their existing accounting systems and processes to ensure compatibility with the 5-4-4 calendar.

- Communication with stakeholders: Businesses need to inform stakeholders about the change in accounting calendar and its implications.

FAQs about the 5-4-4 Accounting Calendar

Q: How does the 5-4-4 accounting calendar affect tax compliance?

A: The 5-4-4 calendar can help businesses optimize tax compliance by aligning tax deadlines with periods of lower revenue. However, it is essential to consult with a tax professional to ensure compliance with specific tax regulations.

Q: Is the 5-4-4 accounting calendar suitable for all businesses?

A: The suitability of the 5-4-4 accounting calendar depends on a business’s specific industry, revenue patterns, and operational needs. It may be particularly beneficial for businesses with seasonal fluctuations in revenue or activity.

Q: What are the challenges associated with implementing the 5-4-4 accounting calendar?

A: Implementing the 5-4-4 accounting calendar can present challenges, including the need to adjust internal processes, communicate with stakeholders, and potentially navigate industry-specific regulations.

Tips for Implementing the 5-4-4 Accounting Calendar

- Consult with accounting professionals: Seek expert guidance from qualified accountants to ensure proper implementation and compliance with relevant regulations.

- Develop a detailed implementation plan: Define clear objectives, timelines, and responsibilities for a smooth transition.

- Communicate effectively with stakeholders: Keep investors, creditors, and regulators informed about the change and its potential implications.

- Monitor and evaluate the impact: Regularly assess the effectiveness of the 5-4-4 calendar and make adjustments as needed.

Conclusion

The 5-4-4 accounting calendar offers a flexible and potentially advantageous approach to financial management. By aligning financial reporting and tax compliance with seasonal cycles, businesses can improve financial planning, cash flow management, and operational efficiency. While implementing this calendar requires careful planning and coordination, the potential benefits for businesses with cyclical revenue patterns make it a valuable option to consider.

Closure

Thus, we hope this article has provided valuable insights into The 5-4-4 Accounting Calendar: Navigating Financial Year-End in 2026. We hope you find this article informative and beneficial. See you in our next article!