Understanding the Importance of a Bill Issuance Calendar: A Guide for 2026

Related Articles: Understanding the Importance of a Bill Issuance Calendar: A Guide for 2026

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the Importance of a Bill Issuance Calendar: A Guide for 2026. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Importance of a Bill Issuance Calendar: A Guide for 2026

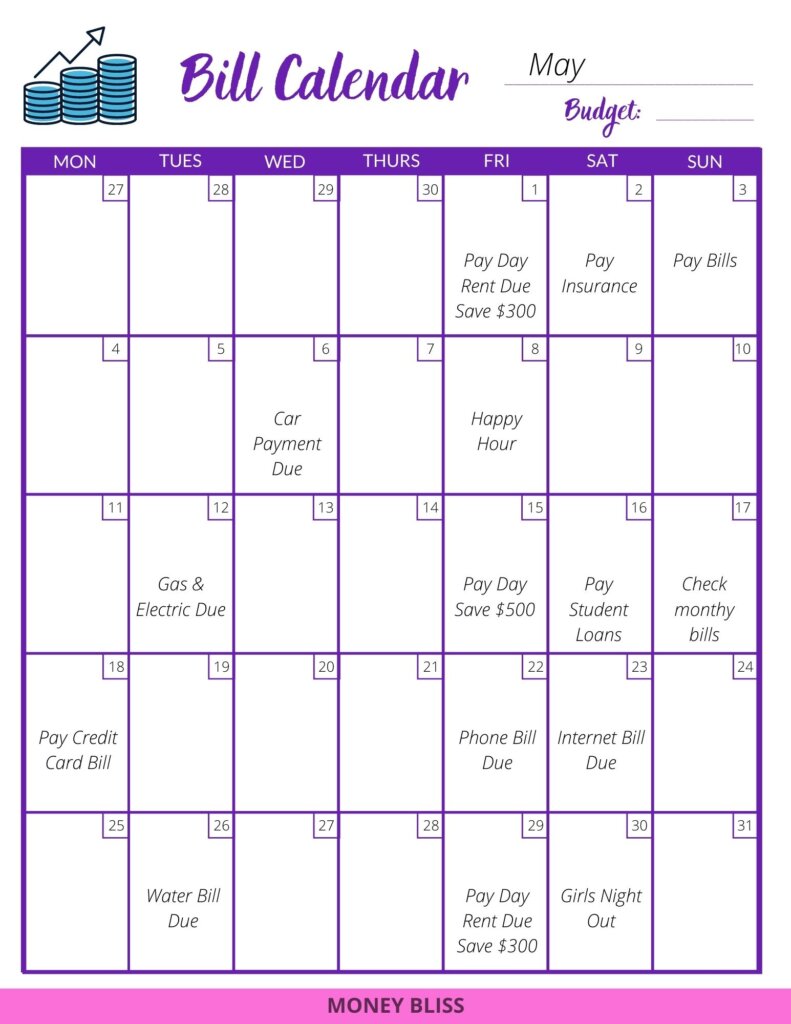

The year 2026 is still a few years away, but for organizations and individuals with financial obligations, planning ahead is crucial. A well-structured bill issuance calendar serves as a vital tool for managing financial responsibilities effectively. This article aims to shed light on the significance of a bill issuance calendar, its benefits, and how it can be utilized to navigate financial obligations smoothly.

What is a Bill Issuance Calendar?

A bill issuance calendar is a comprehensive document that outlines the expected dates for all recurring bills and invoices. It serves as a centralized repository for tracking payment deadlines, ensuring timely payments, and preventing late fees or penalties. The calendar can be tailored to individual needs, encompassing various financial obligations, including:

- Mortgage payments: Keeping track of mortgage payments is essential to avoid default and maintain a healthy credit score.

- Utility bills: From electricity and gas to water and internet, these bills are often due monthly and require careful monitoring.

- Insurance premiums: Ensuring timely payments for insurance policies is vital to avoid lapses in coverage.

- Subscription fees: Streaming services, gym memberships, and other subscriptions need to be paid regularly.

- Loan repayments: Personal loans, student loans, and other credit lines require consistent payments to maintain good credit.

- Tax payments: Property taxes, income taxes, and other tax obligations have specific deadlines that need to be adhered to.

Benefits of a Bill Issuance Calendar:

- Enhanced Financial Organization: A bill issuance calendar promotes financial organization by providing a centralized overview of all upcoming payment deadlines.

- Reduced Risk of Late Payments: By having a clear understanding of payment dates, individuals can avoid late payments and the associated fees and penalties.

- Improved Cash Flow Management: A well-structured calendar allows for better cash flow management, ensuring that funds are available when needed to meet financial obligations.

- Stress Reduction: Knowing when bills are due eliminates the stress and anxiety associated with forgetting deadlines and potential financial consequences.

- Improved Credit Score: Timely payments contribute to a healthy credit score, which is crucial for obtaining loans, credit cards, and other financial services.

- Early Identification of Financial Challenges: A bill issuance calendar can highlight potential financial challenges in advance, allowing for proactive planning and budgeting.

Creating a Bill Issuance Calendar:

- Gather All Bills: Collect all bills and invoices, both paper and electronic, to identify payment deadlines.

- Categorize Bills: Group bills into categories such as housing, utilities, insurance, subscriptions, loans, and taxes.

- Create a Calendar: Choose a preferred method for creating the calendar, such as a spreadsheet, calendar app, or a physical planner.

- Enter Payment Deadlines: Enter the due dates for each bill, ensuring accuracy and consistency.

- Set Reminders: Utilize reminders or notifications to alert you about upcoming deadlines well in advance.

- Regularly Update the Calendar: Ensure that the calendar is kept updated as new bills are received or payment deadlines change.

FAQs Regarding Bill Issuance Calendars:

Q: What if I miss a payment deadline?

A: If you miss a payment deadline, contact the creditor or service provider immediately to explain the situation and explore options for resolving the issue.

Q: How often should I review my bill issuance calendar?

A: It is recommended to review the calendar at least once a month to ensure accuracy and identify any upcoming deadlines.

Q: What if I have multiple bills due on the same day?

A: Prioritize bills based on potential penalties or consequences for late payment. Consider staggering payments to avoid overwhelming your budget.

Q: Can I use a digital calendar app for my bill issuance calendar?

A: Yes, digital calendar apps offer convenient features such as reminders, notifications, and synchronization across devices.

Tips for Effective Bill Issuance Calendar Usage:

- Use a consistent format: Maintain a consistent format for entering bill information to ensure clarity and ease of use.

- Color-code bills: Assign different colors to different categories of bills for visual organization.

- Include contact information: Include relevant contact information for each creditor or service provider.

- Set reminders in advance: Set reminders at least a week or two before the due date to allow for ample time for payment.

- Review the calendar regularly: Ensure the calendar is accurate and up-to-date by reviewing it at least once a month.

Conclusion:

A bill issuance calendar is an indispensable tool for managing financial obligations effectively. By providing a clear overview of payment deadlines and promoting financial organization, it helps individuals and organizations avoid late fees, penalties, and potential financial stress. By incorporating a bill issuance calendar into your financial management routine, you can achieve greater financial stability and peace of mind.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Importance of a Bill Issuance Calendar: A Guide for 2026. We hope you find this article informative and beneficial. See you in our next article!